ato are raffle tickets tax deductible

Funds that are donated in exchange for benefits such as raffle tickets fundraising chocolates or fundraising dinner tickets however genuine are not tax deductible. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372.

Houston Police Officers Union Please Join Us This Friday For A Bbq Benefit Supporting The Gilbert Family Their 16 Year Old Son Was Taken Too Soon In A Tragic Car Accident

However pins tokens wristbands and stickers are.

. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. Ato Are Raffle Tickets Tax Deductible. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations.

To claim a deduction you must have a written record of your donation. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. You cant claim gifts or donations that provide you with a personal benefit such as.

However raffle tickets are not tax deductible. Further conditions for a tax-deductible contribution. August 30 2021 1751.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their. What you cant claim.

Although raffles tickets are a form of donation they are not tax deductible. Even though the charity may eventually get some benefit out of the insurance. All prizes will be donated by local.

Raffle ticket purchases are not tax deductible. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. An organization that pays raffle prizes must withhold 25 from the winnings and report this.

However raffle tickets are not tax deductible. Is money received from a fundraiser taxable. While the popular GoFundMe states its fundraisers are usually considered to be.

The IRS has determined that purchasing the chance to win a prize has value that is.

Ato Tax Deductions These Murky Moves Will Be Watched Closely

Tax Tips The Top 5 Tax Deductions You Can Claim

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

Crypto Staking Taxes Ultimate Guide Koinly

Petrol Is So Expensive Right Now Here S How Much Fuel You Can Claim On Tax Abc Everyday

5 Donations You Can T Claim On Tax This Year And 3 You Can Finder Com Au

A Newsletter For Clients Of Chisholm Partners June Pdf Free Download

Melanie Grohovaz On Linkedin Emj Consulting Is An Expert Restructuring And Insolvency Firm We Focus On

Things Businesses Can T Claim As A Tax Deduction Quickbooks Australia

How To Claim A Tax Deduction On Christmas Gifts And Donations

Top 12 Forgotten Ato Real Estate Tax Deductions Propertyme

Charitable Deductions On Your Tax Return Cash And Gifts

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Is My Donation Tax Deductible Acnc

Common Tax Issues Associated With Making Donations Wolters Kluwer

Mps Councillors Claim The Most Work Related Tax Deductions

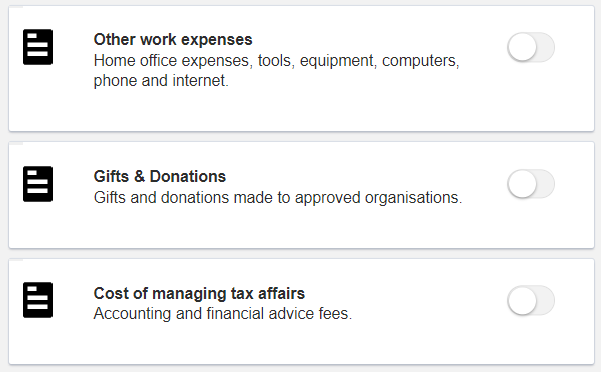

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre

9 Deductions Most Likely To Get You Into Trouble With The Taxman

Donations How To Claim These As A Tax Deduction Precision Taxation Accounting Management